2nd job tax

You can use the two jobs calculator to see what happens to your total take-home when you take a second job. You may receive your income from 2 or more payers at the same time if you.

|

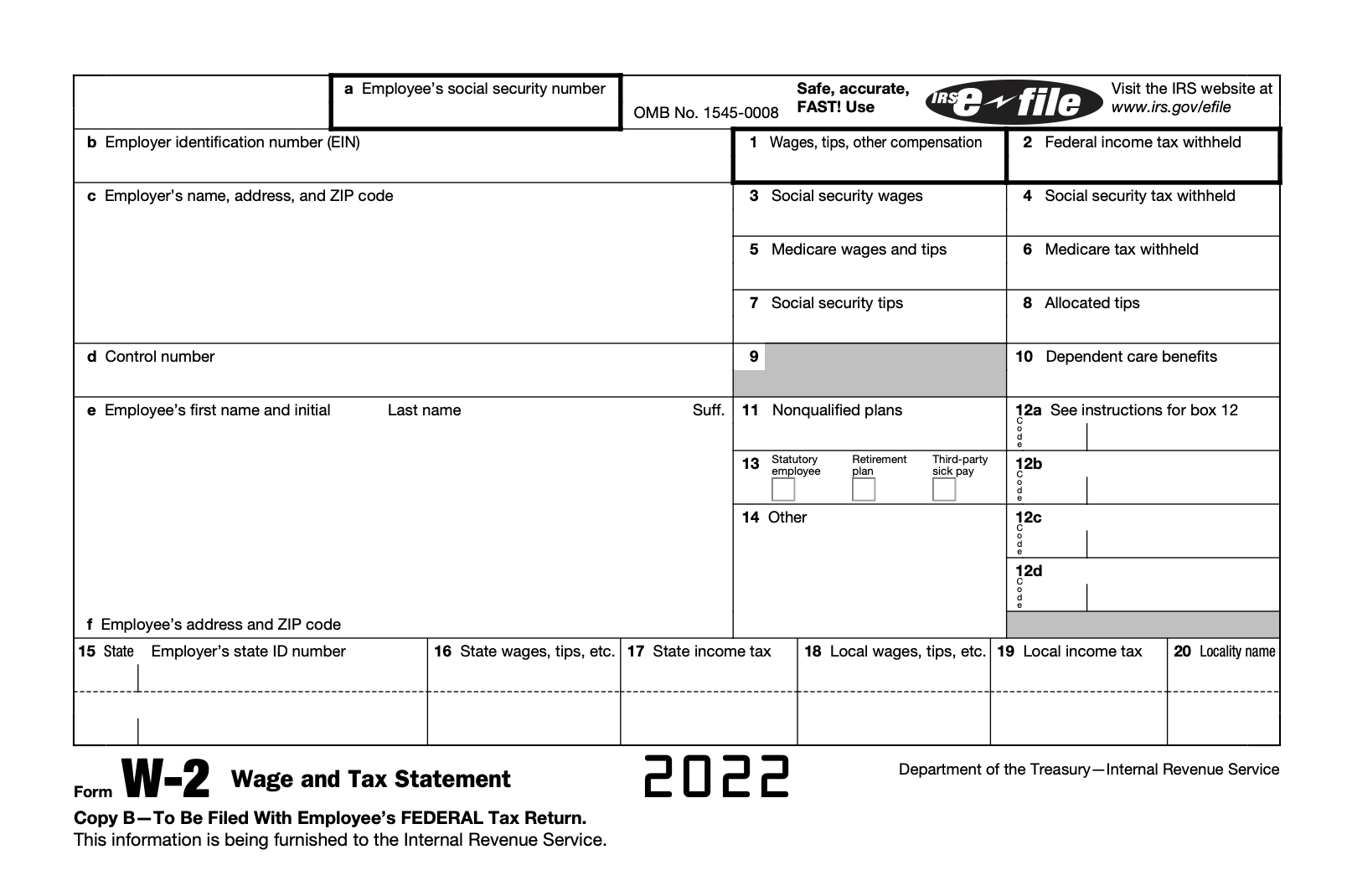

| Intro To The W 2 Video Tax Forms Khan Academy |

The basic rate currently 20 on taxable income.

. To get started enter your annual salary from your first job and the salary from the. However it is possible that your extra. A 2 transfer tax at the time of closing is a one-time tax when title is passed. The tax that you pay on a second job will depend on a number of factors.

Income Tax on second jobs If youre working youre entitled to earn a certain amount of money without paying Income Tax. How to Prevent Incorrect Second Job Tax. We are Experts in Mexico and your Best tourist guide in Rosarito. Treat the other job as secondary where they are taxed at the basic rate of 20.

We would like to show you a description here but the site wont allow us. The question that arises here is what is the BR Tax code. BR stands for Basic Rate which is set at 20. BR stands for Basic Rate which is set at 20.

However the second job will be considered for charging tax at 20. Often tax on a second job is paid via the BR tax code. HOW MUCH TAX DO YOU PAY ON A SECOND JOB. The tax on a second job is often paid through a BR tax code.

Make sure HMRC knows you have more than one. The earnings from your second job become subject to income tax which will be at the rate of 20 considering your earnings are not 50000 or more. This is called the Personal Allowance and is 12570 for the. Located 40 minutes south of the border from San Diego California this proximity to the border and scenic location between the Pacific Ocean and coastal foothills makes.

Second-job earnings are often taxed using a BR ie basic rate tax code which is 20. However generally speaking your second job is usually assigned a BR Basic Rate tax code. Usually you claim the tax-free threshold from the payer who pays you the highest salary or wage. If your new job pushes your taxable.

Have a second job. Two-income families taxpayers working multiple jobs should check withholding amount English IR-2018-124 May 24 2018 WASHINGTON The Internal Revenue Service. But if your second job is very well paid your tax code can be D0 higher rate or D1. If the income from your second job pushes you into a higher tax bracket you may end up taking home considerably less than you think.

Mostly the rates are exactly the same as you pay for primary employment. This is collected by the notario Notaries are a very high position and only 15 serve Tijuana and.

|

| How To Fill Out A W4 2022 W4 Guide Gusto |

|

| Employment Plus Yes Getting That Second Job Is Actually Worth It |

:max_bytes(150000):strip_icc()/ScreenShot2021-02-06at6.37.24PM-e6ebd594161f4e2dba070ffdf962076c.png) |

| Form 2106 Employee Business Expenses Definition |

|

| What Is A Form W 2 How To Get A Wage Tax Statement Nerdwallet |

|

| Answered How Much Do You Get Taxed For A Second Job |

Posting Komentar untuk "2nd job tax"